Compliance Officer

Yinshan Lending Inc.

İş tanımı

Avantajlar

Devletin Zorunlu Sağladığı Faydalar

13. Ay Ödemesi, Çalışan Kredisi, Ücretli tatil

Avantajların Avantajları

Park alanı

Profesyönel geliştirme

Profesyönel geliştirme

The Compliance Officer is responsible for ensuring that the fintech company operates in full compliance with all applicable laws, regulations, and regulatory guidelines. This role acts as the bridge between the business, regulators, and internal teams, ensuring regulatory risks are identified early and properly managed.

Key Responsibilities:

- Ensure the company’s operations, products, and internal processes comply with applicable laws, regulations, and regulatory guidelines.

- Monitor regulatory developments and assess their impact on business activities, products, and internal controls.

- Support regulatory licensing applications, renewals, and periodic reporting requirements.

- Act as a liaison with regulators, industry associations, and external auditors on compliance-related matters.

- Implement, maintain, and monitor AML/CFT, KYC, customer due diligence (CDD), and enhanced due diligence (EDD) procedures.

- Review transactions, reports, and compliance alerts to ensure adherence to regulatory standards.

- Draft, review, and update compliance policies, SOPs, and internal guidelines to align with regulatory requirements.

- Conduct compliance reviews and risk assessments to identify gaps, weaknesses, or potential regulatory risks.

- Recommend and follow up on corrective and preventive actions for identified compliance issues.

- Provide compliance advice and day-to-day guidance to internal teams, including operations, product, marketing, and customer service.

- Review marketing materials, customer communications, and product features to ensure regulatory compliance.

- Support data privacy and data protection compliance, including incident reporting and regulatory notifications.

- Assist in preparing compliance reports for management and regulatory authorities.

- Support internal and external audits, regulatory inspections, and compliance examinations.

-Conduct compliance training and awareness programs for employees to promote a strong compliance culture.

Qualifications:

- Bachelor’s Degree in Finance, Business Administration, Marketing, Accounting, Psychology or a related field.

- Minimum 2-5 years of experience in compliance, risk, legal, or regulatory roles.

- Experience in fintech, banking, or financial services is an advantage.

- Familiarity with AML/CFT, KYC, and regulatory reporting requirements.

- Strong documentation and reporting skills.

Job Type: Full-time

Aljeca Gail Abat

HR AssistantYinshan Lending Inc.

Bugün 0 Kez Yanıtla

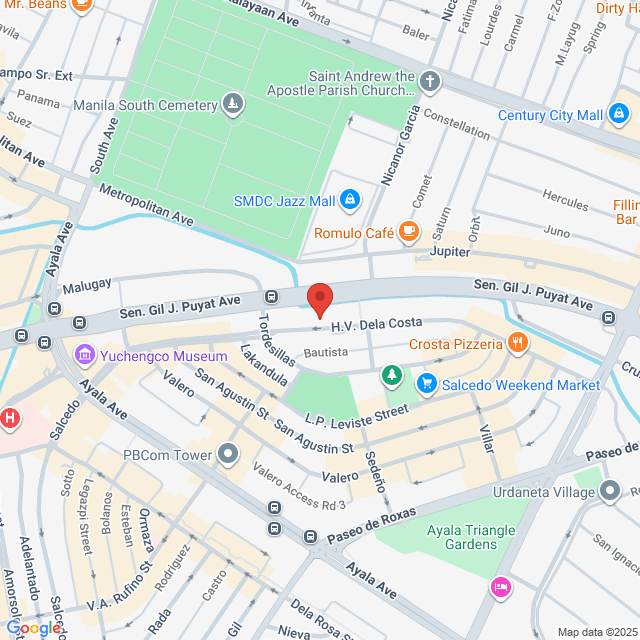

Çalışma konumu

The World Centre Bldg.

Yayınlandı 11 February 2026

Benzer İşler

Daha fazla görParalegal

Cases Collection Management Inc.

Cases Collection Management Inc.₺13.6-16.6K[Aylık]

Tesis içi - Makati<1 Yıl DeneyimÜniversite mezunuTam zamanlı

Willis OrpioTalent Acquisition Specialist

Paralegal Staff

Universal Motors Corporation

Universal Motors Corporation₺15.1-18.9K[Aylık]

Tesis içi - MakatiYeni Mezun/ÖğrenciÜniversite mezunuTam zamanlı

ROWENA BERNARDOHR Officer

Paralegal

INS Immigration Network Services Inc.

INS Immigration Network Services Inc.₺11.3-15.1K[Aylık]

Tesis içi - MakatiYeni Mezun/ÖğrenciÜniversite mezunuTam zamanlı

Anne PatiñoHR Officer

Junior Paralegal / Admin Assistant

Cloudstaff

Cloudstaff₺22.7-30.2K[Aylık]

Tesis içi - Makati1-3 Yıl TecrübeÜniversite mezunuTam zamanlı

Jorge MaximoHR Officer

Paralegal (Corporate Legal Affairs) Japanese Construction firm

John Clements Recruitment, Inc.

John Clements Recruitment, Inc.₺26.4-37.8K[Aylık]

Tesis içi - Makati3-5 Yıl DeneyimÜniversite mezunuTam zamanlı

Jasper De JesusRecruiter

Yinshan Lending Inc.

StratejiFinanse edilmemiş

<50 Çalışan

Bankacılık ve Finansal Hizmetler

İşe alınan iş ilanını görüntüle

Bossjob'a katılın

Bossjob Güvenlik Hatırlatması

Eğer pozisyon yurt dışında çalışmanızı gerektiriyorsa lütfen dikkatli olun ve dolandırıcılığa karşı dikkatli olun.

İş arayışınız sırasında aşağıdaki davranışlara sahip bir işverenle karşılaşırsanız, lütfen hemen bildirin

- kimliğinizi saklıyor,

- bir garanti vermenizi veya mülkünüzü tahsil etmenizi gerektiriyorsa,

- sizi yatırım yapmaya veya fon toplamaya zorluyorsa,

- Yasadışı menfaatler topluyor,

- veya diğer yasa dışı durumlar.